What is the UBC Services Levy used for?

The Services Levy is collected by UBC and deposited into the Neighbours’ Fund which funds the University Neighbourhoods Association. The Neighbours’ Fund contributes to the UNA Operating Budget and Reserves.

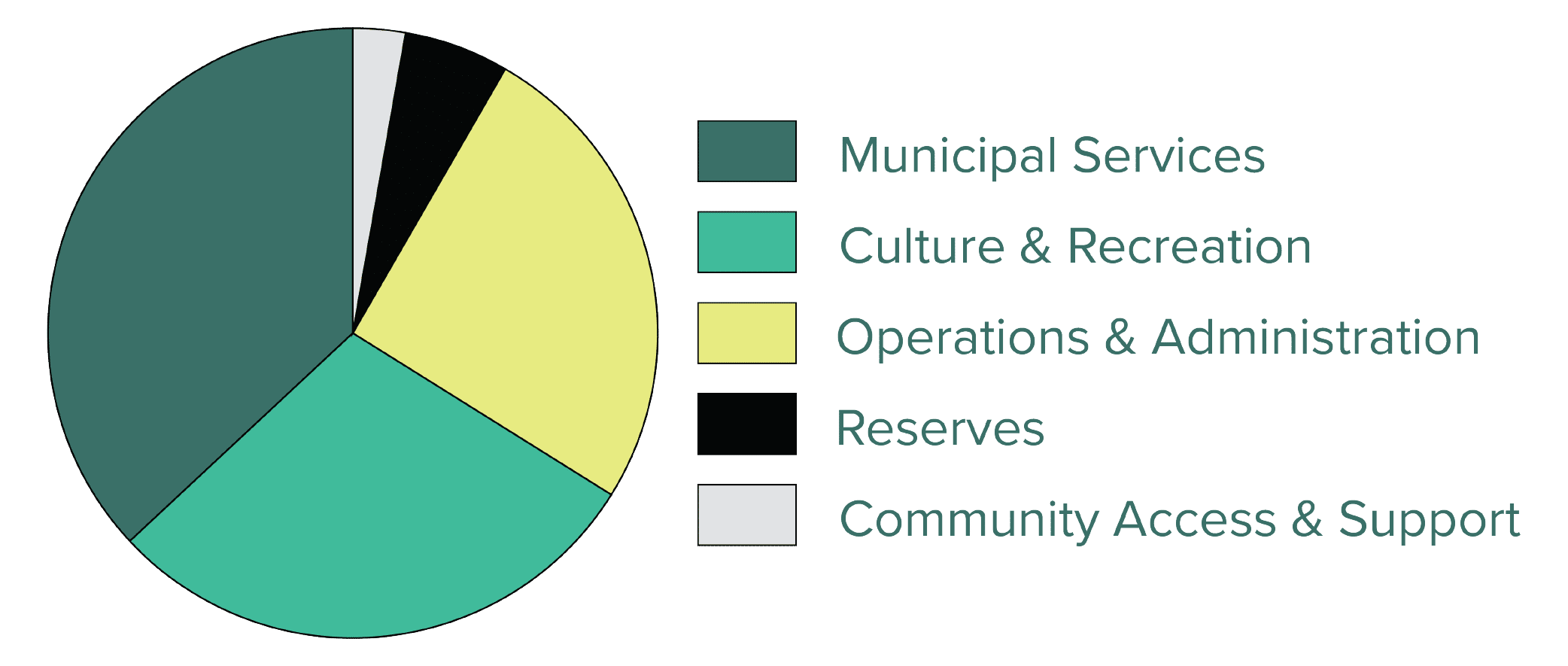

The Operating Budget is used by the UNA to provide municipal-like services to UNA residents including water and sewage, fire services, parking, emergency management, road maintenance, lighting, landscaping, recreation and athletic services, community support and access, and more. The annual budget is developed by the UNA Board of Directors and approved after public consultation. Revenue the UNA generates, mostly through fees for activities and programs it provides, also contributes to the Operating Budget.

The Neighbours’ Fund Reserves are held to meet the future needs of the community. Common among municipalities and many other organizations, reserves are required planning for long-term replacement of infrastructure and to guard against surprise costs.

CANCEL SEARCH

CANCEL SEARCH